The United States may default on its payment obligations between early June and early August if the government does not find a solution fast. In a letter written to Congress by Treasury Secretary Janet Yellen, on Thursday, stated that the U.S. has reached its debt limit and has started to resort to other unconventional ways to keep the government afloat.

“With an additional week of information now available, I am writing to note that we estimate that it is highly likely that Treasury will no longer be able to satisfy all of the government’s obligations if Congress has not acted to raise or suspend the debt limit by early June, and potentially as early as June 1.”

The Treasury Secretary had already warned the country will reach the debt ceiling on Thursday. However, the Treasury Department was preparing a contingency plan to keep the country from defaulting on its debt. One measure being undertaken is suspending investments in the Civil Service Retirement Fund.

Why the Debt Limit is Divisive

Currently, the United States can only borrow up to $31.4 Trillion because the country’s economy runs a deficit and needs to borrow money to pay its bills. Raising the debt limit was previously easy as it has been done 78 times since 1960 but has become increasingly hard to do so.

This is because some House Republicans have vowed to curb any increase in the debt limit to influence spending cuts.

During Former President Barack Obama’s tenure, the U.S. almost defaulted on its debt in 2011. This was due to the political brinkmanship between the House Republicans and the President which resulted in a market sell-off and the first credit rating downgrade for the country.

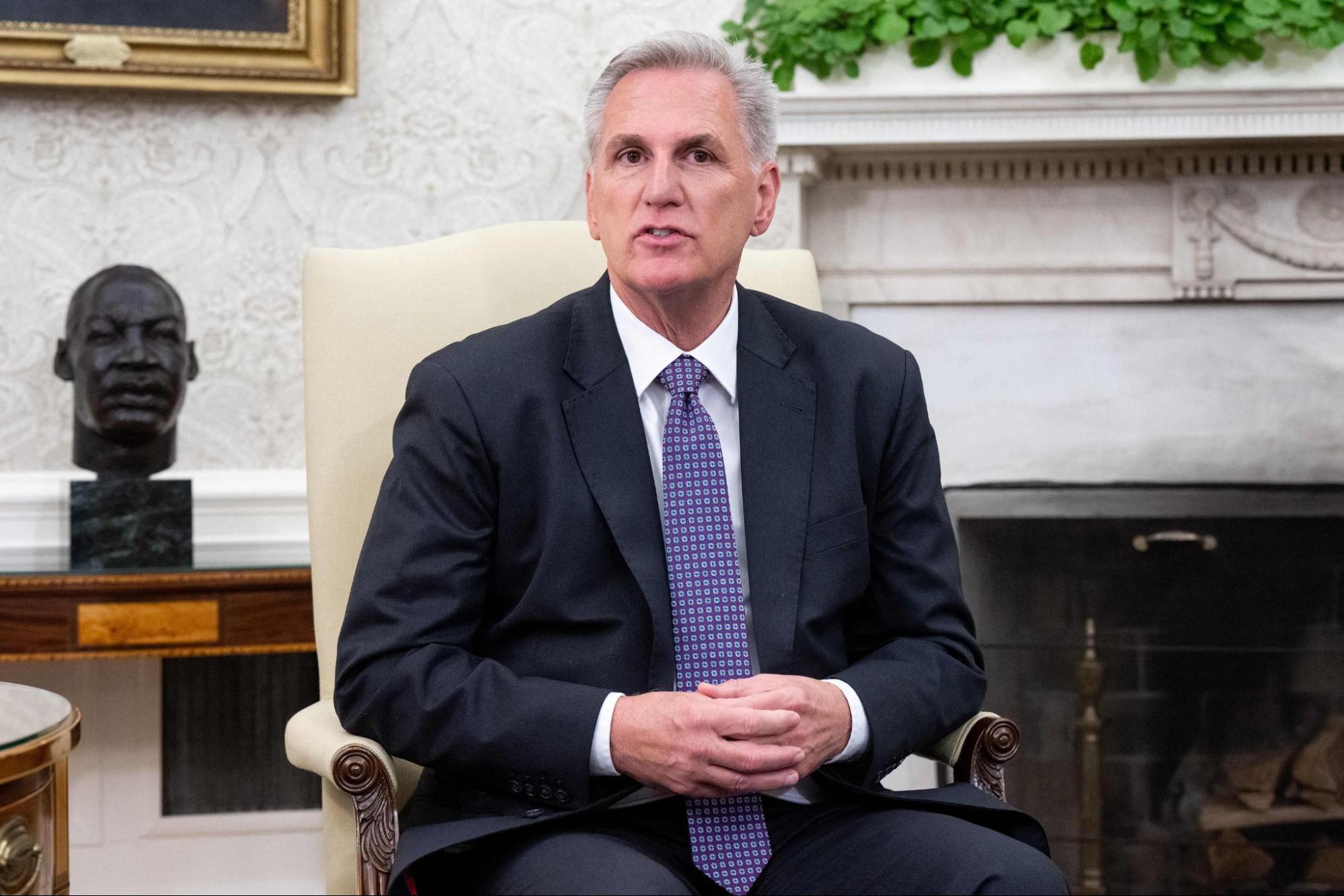

According to House Speaker Kevin McCarthy, the government should be more fiscally responsible and the debt ceiling should be a tool to force the government to reduce its spending.

In the Trump administration, around $7.8 Trillion was added to the national debt which is two times the amount of all the consumer debt in the country excluding mortgages.

What Happens if the Debt Ceiling is Not Raised

If Congress fails to raise the debt ceiling in time, the United States will fall into its first default in modern history. This will see a collapse in stock markets, an unemployment surge, and global economic panic, something echoed in Yellen’s letter.

“We have learned from past debt limit impasses that waiting until the last minute to suspend or increase the debt limit can cause serious harm to business and consumer confidence, raise short-term borrowing costs for taxpayers, and negatively impact the credit rating of the United States.”

The repercussions will also be quickly felt around the world. For example, the Swiss investors who own U.S. Treasury will suffer losses, Chinese factories that sell electronics to the U.S. will dry up and Sri Lankan companies will no longer deploy dollars as an alternative to their dodgy currency.

According to Mark Zandi, the Chief Economist at Moody’s Analytics, even if the debt limit is breached for a week, the economy of the U.S. will drastically weaken so fast and wipe out around 1.5 million jobs. If the period is longer the entire U.S. economic growth will sink. With it, borrowing rates will skyrocket, and the stock market will plunge and erase $10 Trillion in household wealth.

The unemployment rate will rise from the current 3%-4% to 8% and 7.8 million American jobs will disappear.

President Joe Biden’s and McCarthy’s Remarks

For years the dollar has been globally seen as ultra-safe because America always pays its financial obligations. Of late, this has not been the case with President Joe Biden not reaching an agreement with the House Speaker on Monday with just a few days remaining for a possible default.

“We reiterated once again that default is off the table and the only way to move forward is in good faith toward a bipartisan agreement,” Biden said in a statement after the meeting.

The meeting was adjourned for Wednesday behind closed doors in the Capitol where the President, later on, assured the citizens that the country will not default.

“I’m confident that we’ll get the agreement on the budget and America will not default. It would be catastrophic for the American economy and the American people if we didn’t pay our bills,” Biden said. “I’m confident everyone in the room agreed … that we’re going to come together because there’s no alternative. We have to do the right thing for the country. We have to move on.”

McCarthy, however, stated that the President had given ground and the budget talks were still separate from the debt limit issue and he refused to negotiate.

“Keep working — we’ll work again tonight, We’re going to work until we can get it done. McCarthy told reporters.

This comes after President William Ruto warned Kenyans regarding hoarding the dollars, which has caused a dollar shortage in the country.

“I am giving you free advice that those of you who are hoarding dollars you shortly might go into losses. You better do what you must do because this market is going to be different in a couple of weeks.”

The statement was echoed as the country faced a fuel crisis, caused by the shortage of dollars in Kenya. If the U.S. defaults in June, things like loans will be halted which will hurt the economy of Kenya. It will also be hard to do business with the dollar shortage hence affecting imports and exports of goods and services.

Will the United States default for the first time in history?

Keep it C.O.K to find out whether the U.S. will default and how this will directly affect you.